Cyber & Data

Cyber attacks are no longer an ‘if’ but a ‘when’ for many Irish businesses both large and small.

Hiscox have a range of tools and cyber insurance products to help ensure you are protected.

The Cyber Exposure Calculator

The Cyber Exposure Calculator, is free to use and has been designed to help businesses estimate the potential financial impact they may face if they were the victim of a cyber-attack.

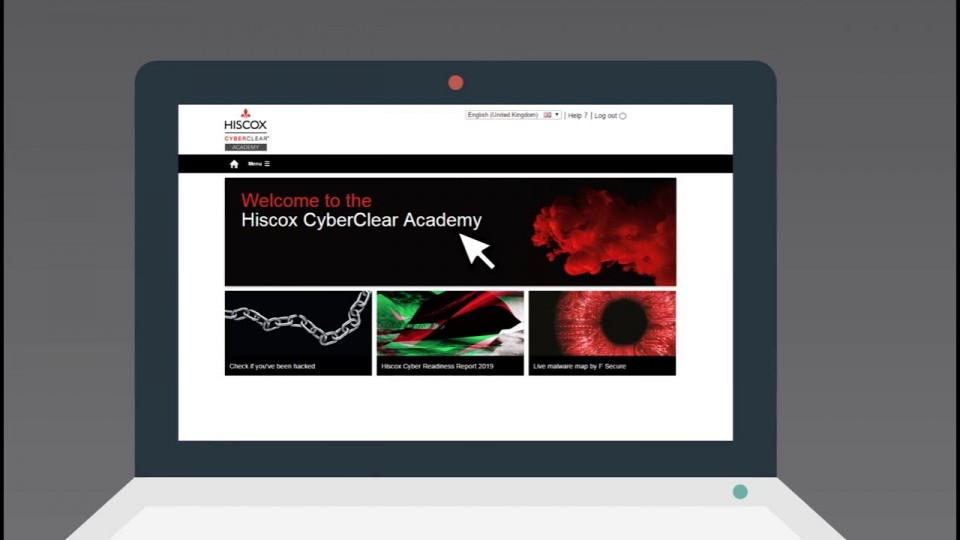

The Hiscox CyberClear Academy®

The Hiscox CyberClear Academy® is a web-based training platform that can assist your clients and their employees in the prevention of network, cyber and privacy losses.

The Hiscox CyberClear Academy®

The Hiscox CyberClear Academy® is a web-based training platform that can assist your clients and the